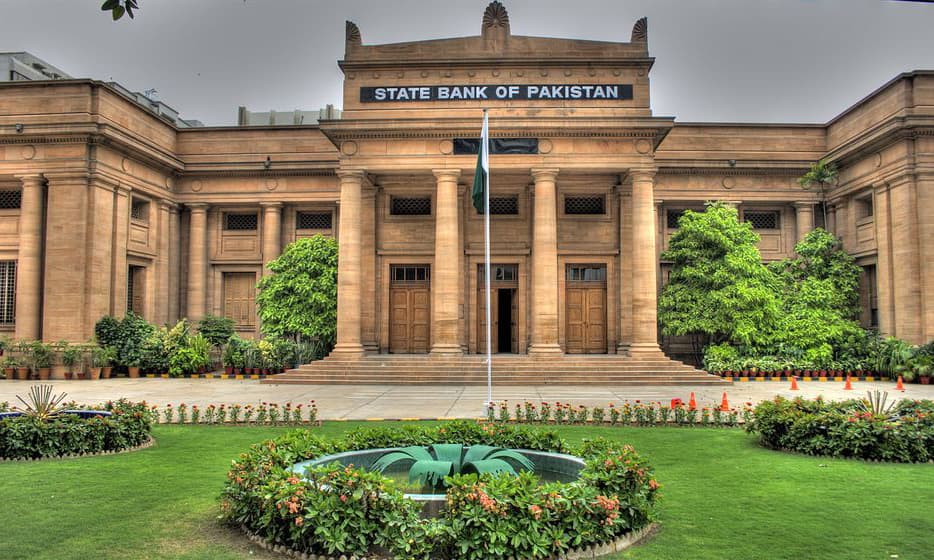

STATE BANK OF PAKISTAN TAKES NECESSARY STEPS TO BOOST THE CONSTRUCTION SECTOR

The State Bank of Pakistan (SBP) has changed its capital ampleness guidelines to offer further help to the improvement of real estate sector by dividing the relevant risk weight on ventures of banks/development finance institutions (DFIs) in the units of Real Estate Investment Trusts (REITs).

The central bank brought down the appropriate risk weight from 200% to 100% on banks/DFIs’ interests in REITs, which raise financing from the overall population and organizations and convey these funds through investment in real estate properties.

This will enable the banks in promoting the development of real estate sector in the country, through the relevant changes in regulations banks/DFIs will now be able to increase their investments in real estate without having to grant a relatively large amount of capital.

It may not be out of place to specify that SBP has been finding a number of administrative ways to improve banks/DFIs’ cooperation in such areas through their financing and venture exercises, in accordance with the public authority’s different initiatives for the advancement of housing and development area.

Besides, the SBP has permitted the banks to count their investments in shares/units/bonds/TFCs/Sukuks given by REIT the executives organizations towards accomplishment of their targets for construction and housing finance. The changes in SBP’s capital sufficiency guidelines will facilitate banks to contribute towards a well-working capital market for the real estate sector.

Recent Comments